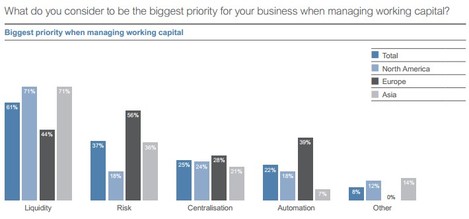

Fig 1: Working Capital Priorities. Source: RBS/Greenwich research (click for larger image) Corporations in the US and Europe are taking an 'extremely conservative' approach to working capital management, according to a new report from RBS and Greenwich Associates. The survey, which saw 50 corporations interviewed in depth, shows that risk-averse strategies adopted during the financial crisis have become the norm, with the overwhelming majority of companies in the US and Asia saying their top working capital priority is liquidity preservation. The list of priorities for all firms in the survey was topped by three concerns: Mitigating counterparty risk from banks, suppliers and vendors; guarding against future funding disruptions by maximising liquidity; and protecting cash balances from market fluctuations by focusing on capital preservation in their short-term investments. Sources: http://www.greenwich.com/ ; http://www.rbs.co.uk/corporate/insight/g4/perspectives/working-capital.ashx

1 Comment

|

Sign up to receive our newsletter

Make sure you hear the news about new courses and other developments in transaction banking by signing up for our newsletter

Categories

All

News & ResourcesWe welcome submissions from educational and commercial organisations, subject to our content guidelines. You can get a monthly update straight to your inbox by signing up below. Archives

July 2018

|

||||||

Transaction Banking Academy is a trading name of Adaugeo Media Ltd. © Adaugeo Media Ltd 2020.

Administrative contact: [email protected]

Privacy Policy (GDPR)

Administrative contact: [email protected]

Privacy Policy (GDPR)

RSS Feed

RSS Feed