The rapidly-changing regulatory environment is holding back growth in global banking, according to a new survey by KPMG. In the Banking Outlook Survey, 69 percent of respondents identified regulatory and legislative pressures as the most significant barrier to growth over the next year, while 43 percent said that bank management will be spending most of its time and energy on initiatives related to increasing operational efficiency and reducing costs in the next two years. “Banks are still in recovery mode after the financial crisis and coming to grips with the new regulatory environment in which they now operate, which is impacting revenue and driving up compliance costs,” said Brian Stephens, national leader of KPMG LLP’s Banking and Capital Markets practice. “‘The new normal’ for the industry seems to be slow and steady growth as banking leaders streamline costs and evaluate strategies to drive future revenue.” According to the KPMG survey, banks are anticipating modest headcount gains in the year ahead, with 39 percent adding to the payrolls and 32 percent decreasing jobs. Stephens feels that hiring will more firmly take hold “when business conditions improve and loan demand picks up.” In the past year, 44 percent of the banking executives said they reduced headcount and 31 percent said they added jobs. “Headcount increases and reductions will be sporadic and largely depend on the mix of businesses within each bank,” said Stephens. A year from now, 6 percent of respondents expect revenue to be significantly higher with the majority (69 percent) eyeing moderate revenue growth. For an insight into adapting IT systems for regulatory change, visit The Forum for Regulatory Change

0 Comments

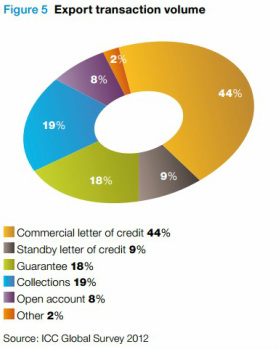

The volume of trade finance transactions continued to increase in 2011, suggesting a slow but steady recovery in world trade, according to the 2012 ICC Global Survey on Trade Finance. The report, which can be downloaded here, polled 229 banks in 110 countries, a greater response than in any previous year, and found that, while world events such as the Arab Spring and Japan's earthquake had impacted on trade volumes, the trend was still upwards.

|

Sign up to receive our newsletter

Make sure you hear the news about new courses and other developments in transaction banking by signing up for our newsletter

Categories

All

News & ResourcesWe welcome submissions from educational and commercial organisations, subject to our content guidelines. You can get a monthly update straight to your inbox by signing up below. Archives

July 2018

|

||||||||

Transaction Banking Academy is a trading name of Adaugeo Media Ltd. © Adaugeo Media Ltd 2020.

Administrative contact: [email protected]

Privacy Policy (GDPR)

Administrative contact: [email protected]

Privacy Policy (GDPR)

RSS Feed

RSS Feed