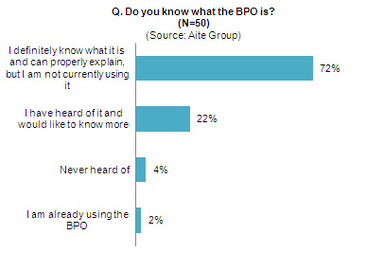

Almost three quarters of banks say they know of and understand Swift's new Bank Payment Obligation, according to new research from The Aite Group. The figures will make comforting reading for Swift and the ICC, which have championed the new instrument, although only 2% of banks are already using it. The Bank Payment Obligation is effectively an electronic replacement for Letters of Credit (LoC) and should help speed up trade finance transactions. “The BPO represents a fresh entry to trade finance,” said report author Enrico Camerinelli, senior analyst with Aite Group and a Transaction Banking Academy tutor. “Its current, lukewarm acceptance by banks and corporations will turn into full endorsement only after real examples prove its use as a payment instrument and risk mitigation tool for trade transactions in any part of the trade lifecycle.” The report is available from Aite Group: http://www.aitegroup.com/Reports/ReportDetail.aspx?recordItemID=930

0 Comments

BAFT-IFSA has updated its trade finance definitions, which offer standard ways of describing trade finance transactions. More details are at BAFT-IFSA, but the definitions can be downloaded below. BAFT-IFSA welcomes input on thse definitions!

|

Sign up to receive our newsletter

Make sure you hear the news about new courses and other developments in transaction banking by signing up for our newsletter

Categories

All

News & ResourcesWe welcome submissions from educational and commercial organisations, subject to our content guidelines. You can get a monthly update straight to your inbox by signing up below. Archives

July 2018

|

||||||||||||||||||

Transaction Banking Academy is a trading name of Adaugeo Media Ltd. © Adaugeo Media Ltd 2020.

Administrative contact: [email protected]

Privacy Policy (GDPR)

Administrative contact: [email protected]

Privacy Policy (GDPR)

RSS Feed

RSS Feed