By Edith Rigler, Transactiuon Banking Academy tutor Mention the phrase “data protection” to someone and you are likely to receive a big yawn. Add the fact that 28 January was European Data Protection Day and you’re just as likely to get a puzzled reaction. You will hear the comment that data protection is a dry subject, which is neither of great relevance or interest. At most, the subject is seen to be relevant to banks - after all, they hold financial data on their customers such as account numbers, balance information, risk and investment preferences, as well as personal information such as names, postal and email addresses and telephone numbers. But data protection as a subject of interest to corporates? Yet data protection and security should concern everyone, be it an individual, a business, a bank or a public authority.

0 Comments

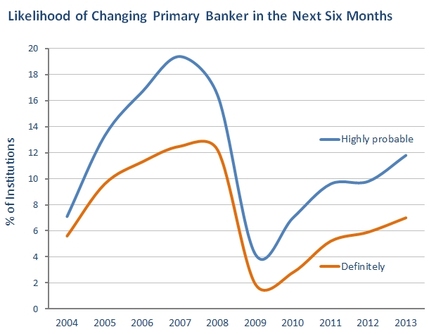

Large global transaction banks could start offloading some of their back-office operations in a bid to cut costs and sharpen their competitive advantage, according to Ed Ho, chief operating officer of Fundtech, interviewed by Euromoney. Full article: http://www.euromoney.com/Article/3348345/Transaction-banks-to-outsource-back-office-operations.html  A new study by Demica measures the level of SCF-dedicated roles in the European banking community, this study examined job titles at the top 50 largest banks in Europe The results of this analysis revealed that: • Close to 45% of top European banks have created SCF-specific roles/job titles; • 30% of top European banks have created SCF-specific roles with directorial status; • 18% have sales functions specifically related to SCF; • 16% have SCF-specific product managers; • 10% have job titles focused on nurturing SCF client relationships. Read the full report here.  Banking Technology has published a special report on the future of payments with contributions from IND and Bank of America Merrill Lynch. "With a revolution in consumer payments happening at the point-of-sale, online and increasingly through the mobile channel, there is a need and an appetite for change across every aspect of the payments industry", says the report. "Real-time account-to-account payments are a reality on several countries, and the US is about to embark on that journey. It will be doing so against a background where money itself is coming under scrutiny as AltCoins like Bitcoin provide a range of alternatives, and in a technical environment where consumerisation, gamification and ubiquitious connectivity are the new buzzwords."  Brussels, 30 January 2014 - The SWIFT Institute will publish a series of research papers in 2014 focusing on key challenges facing the global financial community. Research topics include financial data standards, macroprudential oversight, the unsecured interbank lending market, network liquidity effects, the unit cost of financial services, regulatory compliance and gender diversity in financial services. The research is conducted by academics and senior professionals from across the industry and will be available at http://www.swiftinstitute.org/papers/. Launched in April 2012, the SWIFT Institute fosters independent research to extend the understanding of current practices and future needs across the financial industry. Managed by SWIFT, and working in close collaboration with academics from top international universities, the SWIFT Institute brings the financial industry and academia together to explore ideas and share knowledge on topics of global importance. “SWIFT is uniquely placed to bring thought leadership and strategic thinking to the financial services industry,” said Peter Ware, Director, SWIFT Institute at SWIFT. “Through the SWIFT Institute we have made great strides in achieving this goal and will continue to do so with new research in 2014 related to the reduction of risk and cost, as well as ongoing regulatory changes, amongst other topics. Our aim is to help the global financial community better understand and deal with the challenges it is facing both through new research and greater dialogue at events.” Since its inception, the Institute has issued 14 research grants and published five research projects which have been presented at the Harvard Kennedy School in Boston, Sibos 2013 in Dubai and discussed during the Institute’s event on ‘China’s Emergence in International Finance’ in Shanghai.  Dab: report author Dab: report author Faced with a difficult set of industry trends that threaten to dampen both revenues and profits in the payments and transaction-banking businesses, banks must update their business models if they hope to regain pre-crisis momentum and establish a sustainable growth trajectory, according to a new report by The Boston Consulting Group (BCG). The report, Getting Business Models and Execution Right: Global Payments 2013 offers a comprehensive overview of the industry landscape, as well as detailed analyses of three high-stakes topics: key success factors in wholesale transaction banking, the impact of digital technology on acquirers and payment service providers, and the state of the global cards business. In updating data on payments trends, BCG collaborated with SWIFT, the global provider of secure financial-messaging services. “Payments and transaction-banking businesses represent an increasingly critical element of the banking industry and the global financial-services landscape,” said Stefan Dab, a coauthor of the report and the global leader of BCG’s transaction-banking segment. “Their importance as key generators of stable revenues and customer loyalty will only increase. In our two-speed world of low growth in developed markets and high growth in emerging markets, these businesses are still very attractive, but banks must find optimal business models and excel at execution if they hope to succeed.” According to the report, the payments and transaction-banking businesses generated $301 billion in transaction-specific revenues (including monthly and annual card fees) and an additional $223 billion in account-related revenues (including account maintenance fees and spread revenues) in 2012. The total represented roughly a quarter of total global-banking revenues. Banks handled $377 trillion in noncash transactions in 2012, more than five times the amount of global GDP. By 2022, payments and transaction-banking revenues will reach an estimated $1.1 trillion, a compound annual growth rate (CAGR) of 8 percent. The value of noncash transactions will reach an estimated $712 trillion by 2022, a CAGR of nearly 7 percent. The report notes that there are widening gaps between how payments are evolving in mature economies and their evolution in rapidly developing economies (RDEs). From 2012 to 2022, both payment values and volumes are projected to grow at a CAGR of 11 percent in RDEs, compared with 4 percent and 5 percent, respectively, in the developed markets. Similarly, RDEs will generate stronger revenue growth—a projected CAGR of 12 percent in total payments-related revenues—than the developed markets, which have a projected CAGR of 5 percent. Wholesale Transaction Banking drives returns The report says that current market dynamics are pointing increasingly to wholesale transaction banking as a key lever for improving return on equity in the global banking industry. In 2012, wholesale transaction-banking revenues totaled approximately $220 billion, about 15 percent of the total corporate-banking revenue pool. Nearly $140 billion came from transaction fees and account revenues, which are projected to grow at a CAGR of 10 percent over the next ten years, reaching more than $350 billion. BCG’s research suggests that leading banks, or “transaction-banking champions,” achieve above-average ROE on their wholesale business and also generate more funding (with loan-to-deposit ratios lower than 125 percent). These banks differentiate themselves from their peers with a clear sense of their strategic strengths and boundaries as well as a relentless focus on execution excellence. They pay strict attention to how they sell, how they price, and how they organize their servicing model, cutting across traditional silos. The Impact of Digital Technology According to the report, the digital revolution is having a dramatic impact on retail commerce and how people make purchases. The e-commerce market, estimated at $1.1 trillion globally in 2013 (up from $0.5 trillion in 2002) is expected to grow by 15 percent per year even in mature economies such as the U.S. and the U.K. In this environment, merchants with a brick-and-mortar presence are seeking to defend their market positions from purely online retailers by using their physical assets to create differentiated cross-channel offerings. The report says that global evolution toward more online payments is playing a central role in driving growth in payments-industry revenue pools. In Europe, the revenue pool for payment service providers alone is expected to reach around $1.5 billion by 2016, compared with about $0.8 billion in 2012. In order to thrive in the new environment, acquirers will need to adapt by developing the capabilities to serve pure online and multichannel merchants and continuing to drive improvement in their offerings and operations to cope with new market entrants. The Global Cards Business BCG says that the card industry has emerged from the financial crisis with many challenges to address but also numerous opportunities to capture. The challenges have been brought about by decreased consumer spending, lower receivables (both smaller and fewer), tighter regulation, and intensified competition. The opportunities include potential new revenue streams from a return to basics. These core skills include the following: taking a structured look at customer wallets and identifying the needs being met by competitors; leveraging evolving technologies and approaches (such as those related to mobile wallets and big data); exploring new and disruptive business models (such as those created by partnerships across the value chain); and pursuing underserved customer segments that are ripe for innovation. BCG forecasts that transaction-related revenues generated by consumer-initiated (retail) payments worldwide will increase from $249 billion to $460 billion from 2012 to 2022, a projected CAGR of 6 percent. North America and Asia-Pacific will be the strongest regions, with RDEs in the latter posting the most robust growth. In addition, account-related revenues will grow from $138 billion to $321 billion, a projected CAGR of 9 percent. “In what we call the ‘new new normal’ climate, banks need to become more innovative across the value chain of retail payments—from data analysis, customer segmentation, and product development all the way to rewards bundling and commingling products’ value propositions,” said Carl Rutstein, a coauthor of the report and the leader of BCG’s transaction-banking segment in North America. “The reality is that banks can no longer merely sell products. Rather, they must offer workable and cost-effective solutions to meet customer needs with regard to all types of payments across the entire value chain, paying particular attention to leveraging available technology.” A copy of the report is at www.bcgperspectives.com.  New research from Australian research firm East & Partners suggests Asia's leading corporations are becoming more likely to change their primary transaction banking partner. East & Partners has been surveying Asian institutions since 2004. Back then, 12.7 percent of Asia’s Top 1,000 institutions said a change in their primary transaction banking relationship was either “definite” or “high probable.” By 2009, at the height of the financial crisis, that figure had fallen to 6.1%, but in 2013 that figure has rebounded spectacularly to18.8%. "This equates to just under 200 of the region’s biggest institutions changing bank in the next six months", says East. The next survey takes place in November 2013; meanwhile the current survey is available here.  Werner Steinmueller, Member of the Group Executive Committee and Head of Global Transaction Banking, Deutsche Bank, used the keynote address at the BAFT-IFSA Global Annual Meeting for the Americas in Naples, Florida, to highlight the opportunities created by regulatory change. In his keynote address titled, “No More Words: Time for Action!” Steinmueller emphasized the importance of adapting to a new regulatory environment. “Never before has the transaction banking industry been impacted by such drastic change in a relatively short period of time. Legislation such as Dodd Frank, Basel III, FATCA and SEPA are driving change and need to be addressed head on,” Steinmueller said. “These regulatory developments entail more than just challenges as they can also foster new business solutions and service models. Providers have the opportunity to help clients successfully navigate the increasingly challenging environment so that they can benefit from reduced costs, improved operations and tighter compliance controls.”  The SWIFT Institute, set up to help fund research into the banking industry, has released its first working paper. The research, carried out by US-based Tufts University, shows that mobile money can help to promote financial inclusion and boost savings rates amongst remote communities. The Tufts research is being carried out in rural communities in northern Ghana which have limited access to financial services. A month into the research project, 10% of participants had used the service solely for money transfer; two and half months later, usage increased to 26% of households, with 86% of users receiving money transfers and 70% of users saving on their mobile phone. Download the working paper here Transaction banking is a growth area for banks, with volumes rising steadily. This is generating intense competition in transaction banking services among regional and local banks as well as global incumbents. In a survey-based study by Celent and sponsored by NTT Data Getronics, Trends in Transaction Banking: A Global Survey, Celent finds that banks are racing to enhance product and service menus; automate processes and increase straight-through processing (STP); and build regional—and global—operational and technology platforms to support their business.

“After the global financial crisis, corporates have changed their behavior and are increasingly focused on risk and liquidity management,” adds Axel Pierron, Senior Vice President of Celent’s Securities & Investments Practice and coauthor of the report. “This is creating opportunities for banks, and intense competition in transaction banking services.”

|

Sign up to receive our newsletter

Make sure you hear the news about new courses and other developments in transaction banking by signing up for our newsletter

Categories

All

News & ResourcesWe welcome submissions from educational and commercial organisations, subject to our content guidelines. You can get a monthly update straight to your inbox by signing up below. Archives

July 2018

|

Transaction Banking Academy is a trading name of Adaugeo Media Ltd. © Adaugeo Media Ltd 2020.

Administrative contact: admin@transactionbankingacademy.com

Privacy Policy (GDPR)

Administrative contact: admin@transactionbankingacademy.com

Privacy Policy (GDPR)

RSS Feed

RSS Feed